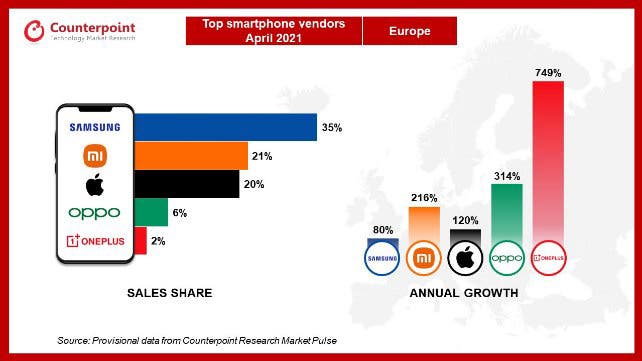

The global smartphone market is constantly changing, and Europe has become an important region for manufacturers who want to expand their business beyond China, India, and the United States, where markets are already saturated. Nowadays, smartphones have become necessary gadgets for almost everyone. We use them for planning our days, business, and entertainment, including playing online casinos wherever we want. For example, Jouerenlignefr offers reviews on all online casinos in French, poker sites, and bookmakers, and above all, exclusive bonuses, gaming news, unpublished news, and sports predictions. According to Counterpoint Research's latest data released in April 2021, we now have a better understanding of the top 5 smartphone manufacturers in Europe, including their market share, performance, and strategies in this dynamic region.

Samsung's Resurgence – 35% Market Share

The South Korean tech giant Samsung has reclaimed its throne in Europe with a 35% market share. The success can be attributed to the strong performance of its latest Galaxy S21 series, with the Galaxy S21 Ultra gaining significant traction among European users. Additionally, mid-range smartphones like the Samsung Galaxy A50 and Galaxy A20 played a vital role in bolstering the company's market position.

Despite facing a challenging 2020, Samsung witnessed an 80% year-on-year increase, marking a positive turn for the company. With a dominant position in the European market, Samsung is poised to continue its upward trajectory and potentially claim more market share throughout the year.

Xiaomi's Mid-Range Triumph – 21% Market Share

Xiaomi, often considered the underdog, has emerged as a major player in Europe with a 21% market share. The Chinese manufacturer strategically focused on offering flagship features at mid-range prices, carving a niche for itself in the fiercely competitive market. Xiaomi's success in Southern Europe is highlighted by its takeover of Spain's largest smartphone vendor position and securing the second spot in Italy.

Xiaomi's year-on-year increase of 216% showcases its rapid ascent, particularly noteworthy given the challenges posed by the COVID-19 pandemic in April 2020. By avoiding direct competition with established giants like Apple and Samsung, Xiaomi has successfully positioned itself as an attractive and cost-effective alternative for European consumers.

Apple's Steady Climb – 20% Market Share

While Apple may not dominate the European market as it does globally, the company secured a respectable third position with a 20% market share. At the same time, Apple is still the clear leader in France, Germany, and the UK and continues to be friendly for playing casinos, poker sites, and bookmakers in these countries. The iPhone 12 series, released in October 2020, contributed significantly to Apple's success, with both the iPhone 12 and iPhone 12 Pro witnessing robust sales. Surprisingly, the demand for the 4G iPhone 11 Pro and 11 Pro Max remains strong in Europe.

Apple's 120% year-on-year increase underscores its resilience and consumer appeal, showcasing the enduring popularity of its devices even in a competitive market. The iPhone 12 series continues to drive revenue growth globally, with expectations of sustained demand in the second quarter of 2021.

Oppo's Strategic Gains – 6% Market Share

Oppo, a beneficiary of Huawei's challenges in the European market, has seen a remarkable 314% year-on-year increase in sales. Capitalizing on the void left by Huawei, Oppo's FIND and Reno series played a pivotal role in achieving record shipments and revenues in the year's first quarter.

The Chinese manufacturer's market share is on the rise not only in Europe but also in regions like China, Latin America, and South Asia. Oppo's performance reflects a successful strategy of filling the vacuum created by Huawei's setbacks and gaining traction with its innovative offerings.

OnePlus' Surprising Surge – 2% Market Share

OnePlus, with just a 2% market share, may seem like a minor player, but its astonishing 749% year-on-year increase in sales cannot be ignored. Boasting 10 million users globally, 30% of whom are in Europe, OnePlus has made a significant impact with its 5G devices, particularly those priced between €400-500.

The brand's rapid growth in Europe demonstrates the appeal of its devices, especially in the mid-range segment. OnePlus has managed to carve out a niche and attract a dedicated user base, positioning itself as a notable contender in the European smartphone market.

Conclusion

The smartphone market in Europe is undergoing a change in power dynamics, with major players such as Samsung, Xiaomi, Apple, Oppo, and OnePlus competing for dominance. The renaissance of Samsung, the success of Xiaomi in the mid-range market, the steady progress of Apple, the strategic gains of Oppo, and the unexpected surge of OnePlus all reflect the shifting preferences of European consumers. All these brands also attract the attention of gambling fans, allowing them to enjoy their favorite slots in online casinos fully. As the market continues to recover from the challenges of 2020, these manufacturers are likely to intensify their efforts to win over European smartphone users and become the preferred choice.